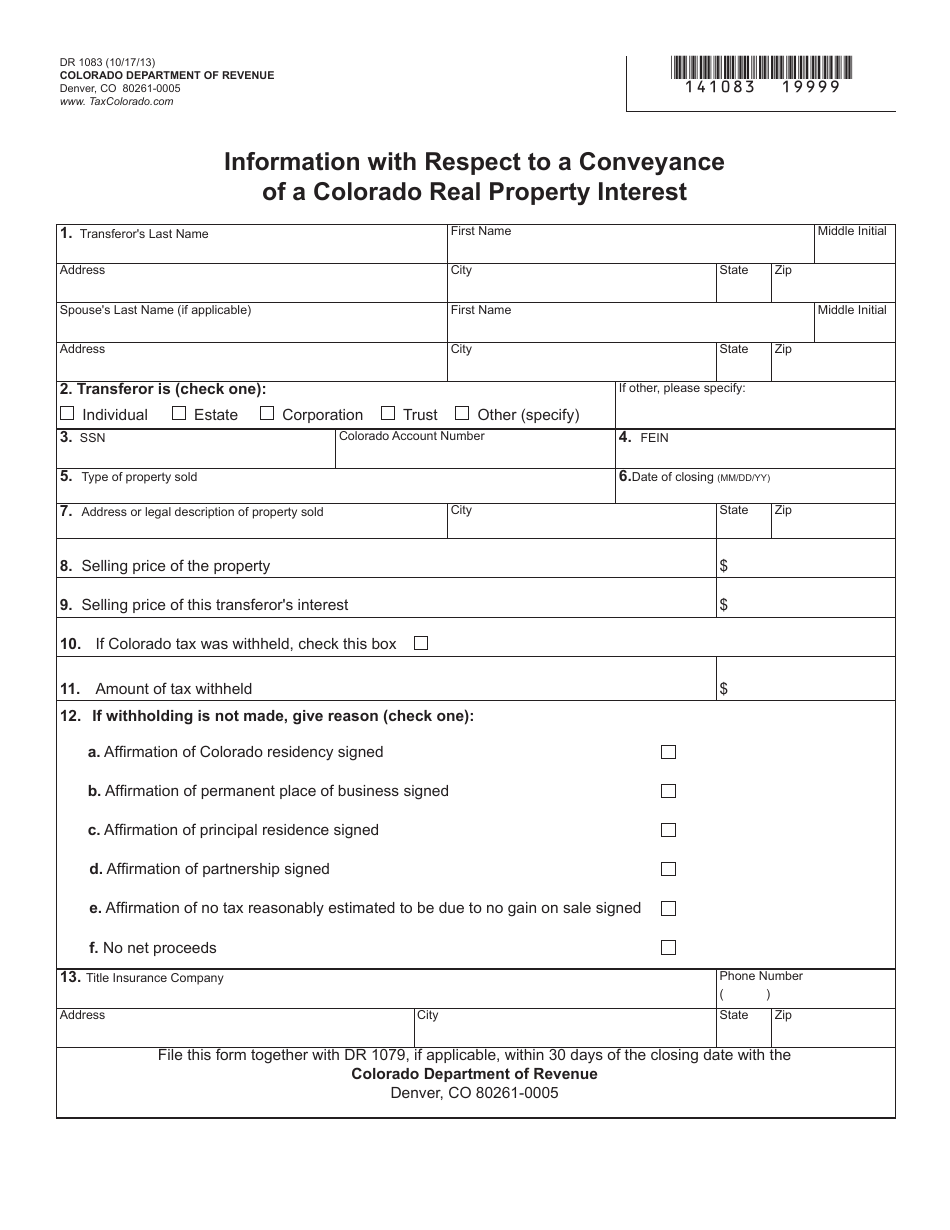

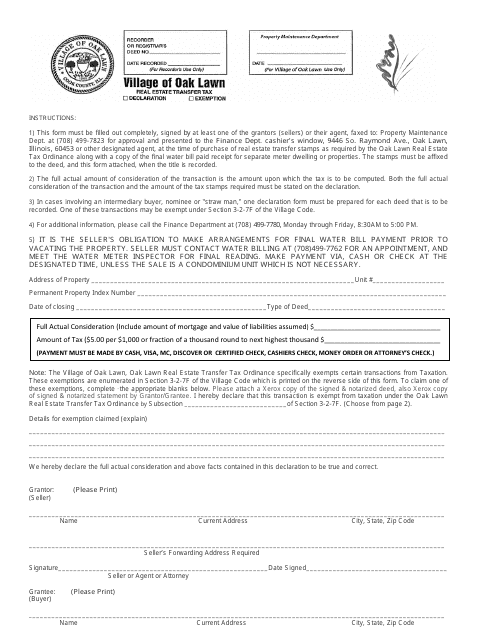

Summary State law generally requires a person who sells real property for at least 2,000 to pay a tax on the property’s conveyance.

This report updates OLR Report 2017-R-0107. Jones, husband and wife, as tenants by the entirety, and not as tenants in common…. Explain Connecticut’s real estate conveyance tax. Sample language: “…to Grantees, Alice K.This is also called “community property.” Each spouse owns the whole property and neither can transfer their right in the property without the consent of the other spouse. Jones, as joint owners with rights of survivorship, and not as tenants in common.…” X Research source When one dies, the other grantee gets the share automatically. Jones, as tenants in common, the following described real estate, together with rents, profits, fixtures, and other appurtenant interests, in Dane County, State of Wisconsin (‘Property’):” of 4 TP-584-NYC (9/19) Part 4 Explanation of exemption claimed on Part 1, line 1 (mark an X in any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Language to create a tenancy in common would read: “Grantor, for a valuable consideration, conveys to Grantees, Alice K. For the transfer of legal title of real property from one person to another, subject to a conveyance fee based on the value of real estate.Also, when one owner dies, their share can be left to whoever they want. Either person can sell their share when they want. For example, you might transfer property to two siblings, one of whom will take 70% ownership and the other will take 30% ownership. People can hold a property in the following ways: X Research source If you are transferring the property to more than one person, then you have to specify how the grantees will hold the property. X Research source Grant deeds are not available in all states. With a grant deed, the seller promises that the title hasn’t been transferred to someone else. Real Estate Conveyance Form (DTE100) Real Estate Exempt Conveyance Form (DTE100EX) Statement of Conveyance Homestead Property (DTE 101). Real Property Conveyance Fee form (DTE Form 100EX). Yes If Yes, attach OP-236 Schedule A - Grantors, Supplemental Information for Real Estate Conveyance Tax. Since a certificate of transfer of real estate and affidavit for transfer of real estate are not forms. X Research source Because quitclaim deeds provide less protection, they are usually used to transfer property between family members or between close friends. Complete Form OP-236 in blue or black ink only. However, the seller does not promise that it actually owns the title to the property. With a quitclaim deed, the seller transfers whatever interest in the property that they own. You should use it if you don’t know the seller. A warranty deed provides the buyer with the most protection. X Research source If the seller does not actually hold title, then the buyer can sue for compensation. With this deed, the seller guarantees that he or she owns the property being transferred. But they differ in the amount of protection that they give the buyer. Upon the appointment of a successor Trustee, the Trustees upon the effective date of such Acceptance of Trust by a successor Trustee will be deemed to have conveyed, assigned, transferred or made over to the successor Trustee all the rights to and property of the Fund and will sign all documents and deeds as may be necessary to convey a joint legal interest in the rights to and property of the Fund to the successor Trustee.Decide on the type of deed. Each Trustee, by signing this Agreement, or an Acceptance of Trust, constitutes and appoints the remaining Trustees as his or her attorneys, to sign all documents and deeds in such Trustee’s name as may be necessary to convey his or her legal interest in the rights to and property of the Fund to the other Trustees upon the Cessation Date. Complete List of Online Forms (Select Real Property under 'Tax Type'.) Board of Revision - Visit the website for more information 2022 Board of Revision Form (PDF) BOR Rules and Procedures Homestead Exemption. Every person ceasing to be a Trustee hereunder is deemed to have conveyed, assigned, transferred or made over to the remaining Trustees upon such person’s Cessation Date any or all the rights to and property of the Fund, and will, if necessary, convey, assign, transfer and make over to the remaining Trustees upon the Cessation Date any or all the rights and property of the Fund as the remaining Trustees may direct.

0 kommentar(er)

0 kommentar(er)